dependent care fsa eligible expenses

It covers medical dental vision and pharmacy expenses. In other words you and your spouse may not each claim 5000.

Limited Purpose Fsa Lpfsa Optum Financial

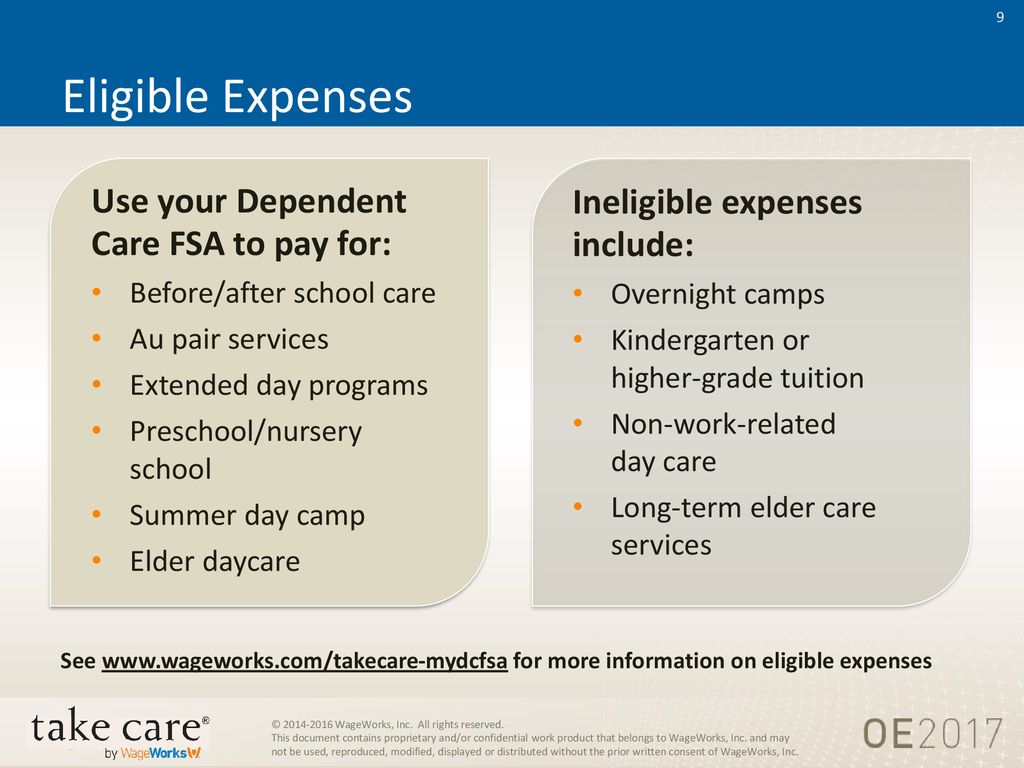

The IRS determines which expenses are eligible for reimbursement.

. These lists are extensive and represent the most common types of expenses but they are not all-inclusive. Learn More about DeCAP. Watch the DeCAP Video.

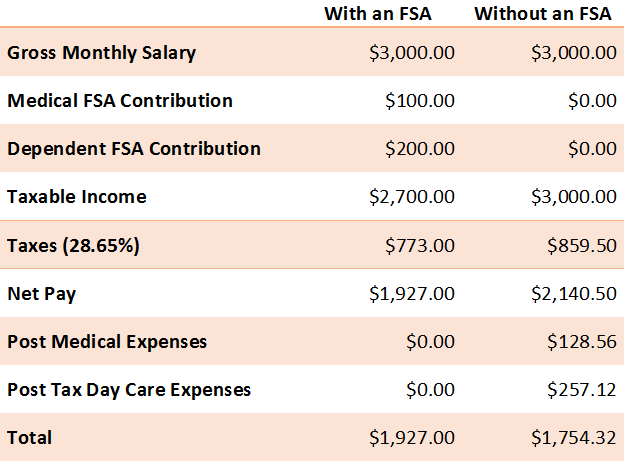

Limited Expense Health Care FSA. These deductions reduce an employees gross income on hisher Form W-2 for federal and Social Security tax purposes. This type of FSA is offered by most employers.

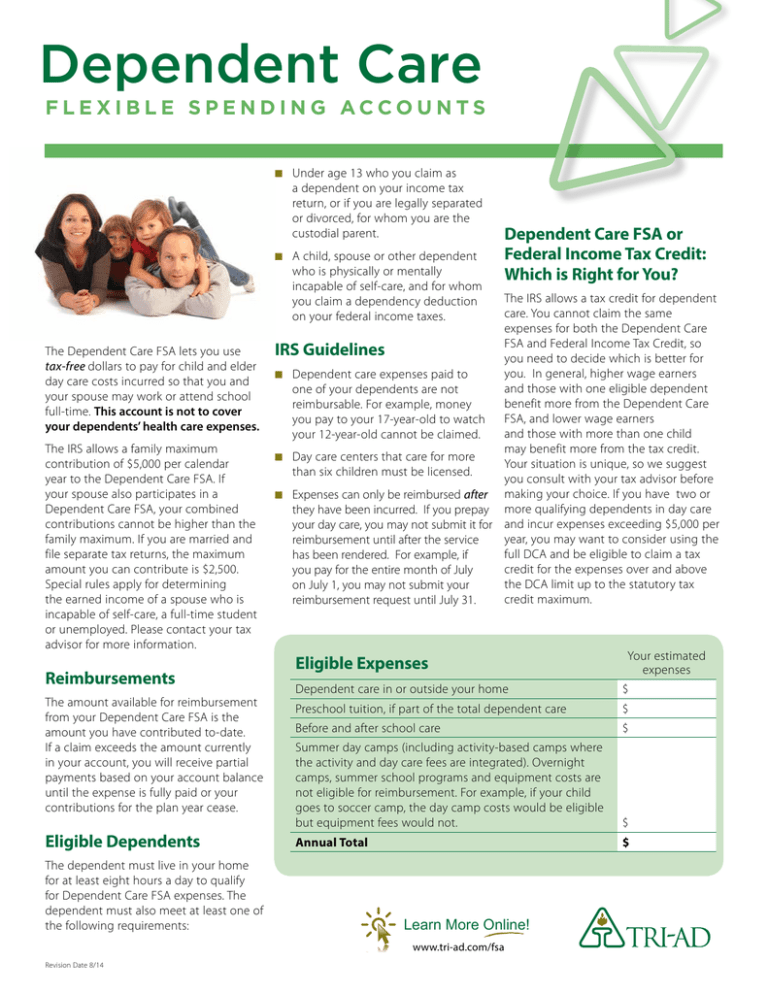

Dependent Care FSA Eligible Expenses ConnectYourCare 2020-12-31T102852-0500 We all need to work in order to provide for our families. Please note you may not double-dip expenses eg expenses reimbursed under your Dependent Care FSA may not be reimbursed under your spouses Dependent Care FSA and vice versa. The American Rescue Plan Act of 2021 was enacted on March 11 2021 making the Child and Dependent Care credit substantially more generous and potentially refundableup to 4000 for one qualifying person and 8000 for two or more qualifying persons only for the tax year 2021 This means an eligible taxpayer can receive this credit even if they owe no federal income tax.

This applies even if the camp specializes in sports ie basketball volleyball etc or computers. How It Works Step 1 Determine Your Annual Election. The IRS determines which expenses can be reimbursed by an FSA.

Eligible expenses include health plan co-payments dental work and orthodontia eyeglasses and contact lenses and prescriptions. What Are My FSA Eligible Expenses. Day camp expenses are eligible for reimbursement from a Dependent Care FSA as long as they provide custodial care for children under the age of 13 so the parents can work look for work or attend school full-time.

A flexible spending account FSA is offered through many employer benefit plans and allows you to set aside pretax money for eligible health care-related out-of-pocket expenses for you your. However you may still be eligible to claim a credit on Form 2441 line 9b for 2020 expenses paid in 2021. The maximum amount available if you are married but filing separate returns is 2500.

Keep in mind you may carry over up to 57000 remaining in your account. The term dependent care assistance means the payment of or provision of those services which if paid for by the employee would be considered employment-related expenses under section 21b2 relating to expenses for household and dependent care services necessary for gainful employment. This is why leveraging Dependent Care FSA funds to cover dependent care expenses is critical.

For 2021 the credit figured on Form 2441 Child and Dependent Care Expenses line 9a is unavailable for any taxpayer with adjusted gross income over 438000. If you are eligible to participate in the FSAFEDS program decide how much to contribute to your Health Care FSA account based on how much you plan to spend in the upcoming year on out-of-pocket medical dental and vision care expenses. To find out which expenses are covered by FSAFEDS select the account type you have from the list below.

DeCAP allows City employees to pay for eligible dependent care expenses on a pre-tax basis with deductions taken directly from paychecks.

File A Dca Claim American Fidelity

Dependent Care Flexible Spending Accounts Flex Made Easy

Dependent Care Fsa Flexible Spending Account Ppt Download

Dependent Care Fsa Flexible Spending Account Ppt Download

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Why You Should Consider A Dependent Care Fsa

How To File A Dependent Care Fsa Claim 24hourflex

Using Your Dependent Care Fsa To Pay For Daycare Quality For Kids

Your Flexible Spending Account Fsa Guide

Dependent Care Open Enrollment 24hourflex

What Is A Dependent Care Fsa Wex Inc

How To File A Dependent Care Fsa Claim 24hourflex

Health Care And Dependent Care Fsas Infographic Optum Financial